British start-up Graphcore claims it has shipped “tens of thousands” of its AI chips, or intelligence processing units (IPUs), to companies around the world.

Nigel Toon, co-founder and CEO of the U.K.-headquartered company, told CNBC that Graphcore is now “shipping in volumes” thanks to partnerships with Microsoft and Dell. He said the numbers are in the tens of thousands as opposed to the hundreds of thousands.

The race to develop AI-optimized chips is well and truly underway, with Santa Clara heavyweights Intel and Nvidia being two of the obvious front runners given their expertise in chip making. The companies haven’t disclosed how many of their AI-optimized chips have been sold.

However, over a trillion computer chips are expected to be shipped in 2020, according to market data website Statistica. In 2019, Intel’s slice of the overall chip market came in at 15.7% and it has been the market leader every year since 2008, with the exception of 2017 when Samsung took the number one spot.

Google, Amazon and Apple are also working on their own AI chips.

A new era for chips

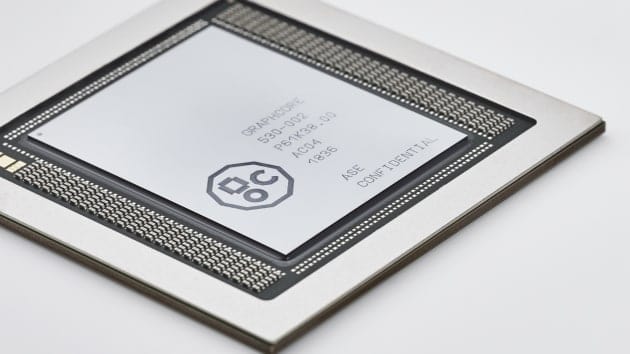

Built in Taiwan by chip manufacturer TSMC, Graphcore’s chips are designed to support the development of AI applications and other power hungry software. Traditionally, graphics processing units (GPUs) have been used for intensive computing tasks, such as training an AI model, but their power is limited by their design.

Valued at around $2 billion, Graphcore sells its chips on cards that contain two IPUs each and have a list price of around $10,000. “Obviously, depending on who the customer is there’s different discounts that apply and different prices that are negotiated,” said Toon.

A deal between Microsoft and Graphcore last November means the four-year-old start-up’s chips are now being used on computer servers in Microsoft data centers. As a result, Azure users can use Graphcore’s chips to power their applications.

Graphcore’s chips have also been incorporated into a new Dell IPU server, providing Graphcore with another route to market.

Over 100 organizations are using Graphcore’s hardware in some shape or form, Toon said, calling out universities such as Oxford, Imperial College London and the University of California, Berkeley.

Naming corporate customers is harder, however. Toon declined to comment when asked if U.S. tech giants like Google, Facebook, Amazon and Apple are using the company’s chips. “We’re a bit careful about customers because sometimes they don’t want to say what they’re doing,” he said.

Speed-up

A couple of firms have, however, spoken publicly about their experience with Graphcore’s chips.

European search engine Qwant said it witnessed a 3.5x speed-up in its image search application after adopting Graphcore chips, while hedge fund Carmot Capital said it witnessed speeds 26x faster on certain financial applications.

Microsoft is the biggest of the bunch though and Microsoft researcher Sujeeth Bharadwaj said on Wednesday that he was able to train an AI model to spot pneumonia in chest X-rays in 30 minutes with a Graphcore IPU on Azure. The same task took him five hours with a high-end GPU system, he said.

“That reduction in time can mean achieving better and unprecedented results much faster,” said Bharadwaj, lead researcher at Microsoft Azure.

Graphcore revenues for the last financial year were in the order of $10 million, Toon said, adding that it is now “growing very quickly.”

The company has raised over $450 million from the likes of Sequoia, BMW, DeepMind’s cofounders and C4 Ventures.

Pascal Cagni, a former VP for Apple in Europe and a partner at C4 Ventures, told CNBC that he backed Graphcore after realizing new machine engines are required to deal with the increasing volumes of data in the world.

“We wanted to show not everything is happening in Santa Clara,” said Cagni.

Some of Graphcore’s funding has been used to open a new office in Cambridge, which is a major hub for tech talent in the U.K.

Graphcore announced the Cambridge office last May alongside plans to hire 500 additional workers across its locations. Toon said that the overall company headcount currently stands at around 450 people, adding that there are around 30 workers in Cambridge.

Graphcore isn’t actively looking for more funding but investors are still trying to secure equity in the company, Toon said.

In 2011, Toon sold previous semiconductor company Icera to Nvidia for around $435 million but this time he wants to go public. “That would be what we would hope to try and achieve,” he said.