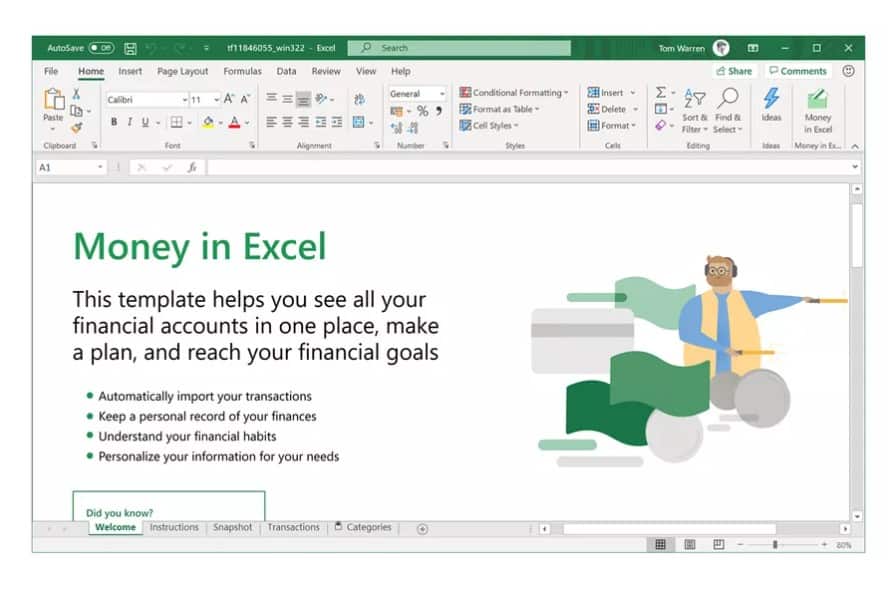

Microsoft is launching a new Money in Excel feature that’s designed to help the millions of people who use Excel to track budgets and personal finances. Money in Excel is a template and add-in for Excel that allows Microsoft 365 subscribers to securely connect to bank, credit card, investment, or loan accounts and import transactions and account information directly into a spreadsheet.

You’ll need to be a Microsoft 365 Personal or Family subscriber in the US to get access to Money in Excel, and you can simply download the template to begin connecting bank accounts through the Plaid connector. Most major US financial institutions are supported, and the template will automatically import transactions from accounts into a single workbook.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/20036967/Money_in_Excel_2_2048x1152.png)

Transactions are categorized to make it easy to analyze how you’re spending your money, and there are even alerts for increases to subscription fees or bank and overdraft charges. Money in Excel also automatically generates charts for recurring expenses, or a monthly snapshot of spending that’s easy to glimpse.

This isn’t Microsoft’s first foray into personal finance products. Money in Excel follows Microsoft’s discontinued personal finance management software, Microsoft Money. Microsoft scrapped Microsoft Money more than 10 years ago, but an MSN Money app returned to the Windows Store back in 2012 as a news aggregator and for tracking stocks.

If you’re interested in trying out Money in Excel you’ll need to be subscribed to Microsoft 365, priced at $6.99 per month for Personal (one person) or $9.99 a month for a Family (up to six people). Money in Excel is limited to the US right now, so only US bank and financial accounts will work with the feature.