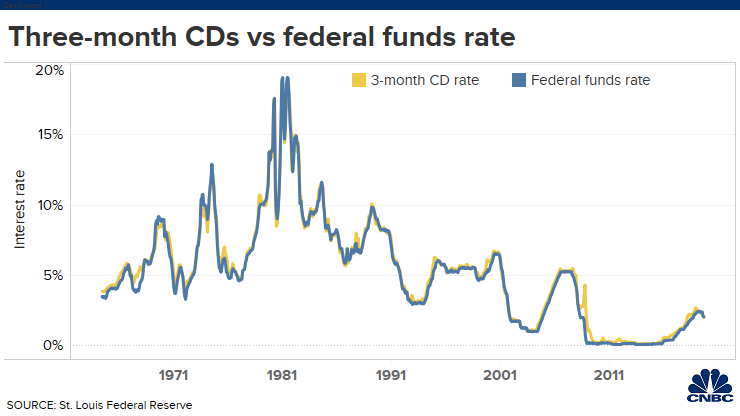

Up until recently, an old-fashioned certificate of deposit was a reliable way to lock in a decent return.

Now, some CD rates are hitting all-time lows and could still fall further, according to Ken Tumin, founder of DepositAccounts.com.

“Since March, rates have taken a nosedive,” he said. “I’m not sure where they will bottom.”

In the wake of Covid-19, a spike in savings, coupled with the Federal Reserve’s move to hold its benchmark rate at essentially zero, has put pressure on deposit rates across the board, Tumin said.

Currently, top-yielding CD rates are averaging just over 1% — only slightly better than a high-yield savings account, if at all.

For example, Ally Bank is offering a one-year CD with an annual percentage yield, or APY, of 1%, which is even lower than the 1.1% the bank pays on a savings account.

A better bet could be high-yield reward checking accounts, Tumin said, which are offered at some regional banks and credit unions. Those can pay as much as 3% on deposits, although not all customers will qualify.

Unlike regular checking accounts, which often impose minimum-balance requirements, high-yield accounts have maximum balance limits of $10,000 to $20,000, depending on the bank, and could also require a minimum number of monthly debit card transactions among other conditions.

Typically, the longer the term of the CD, the higher the interest. The CDs that offer the highest yields not only require longer periods to maturity but also have higher minimum deposit requirements versus a savings account. That means that money isn’t as accessible.

However, not all CDs penalize you for withdrawing money before the CD matures. About half a dozen online banks are offering so-called no-penalty CDs, according to Tumin.

Further, some banks, including Marcus and Citi, are now allowing customers impacted by the coronavirus crisis to break certificates of deposit early and are waiving fees.