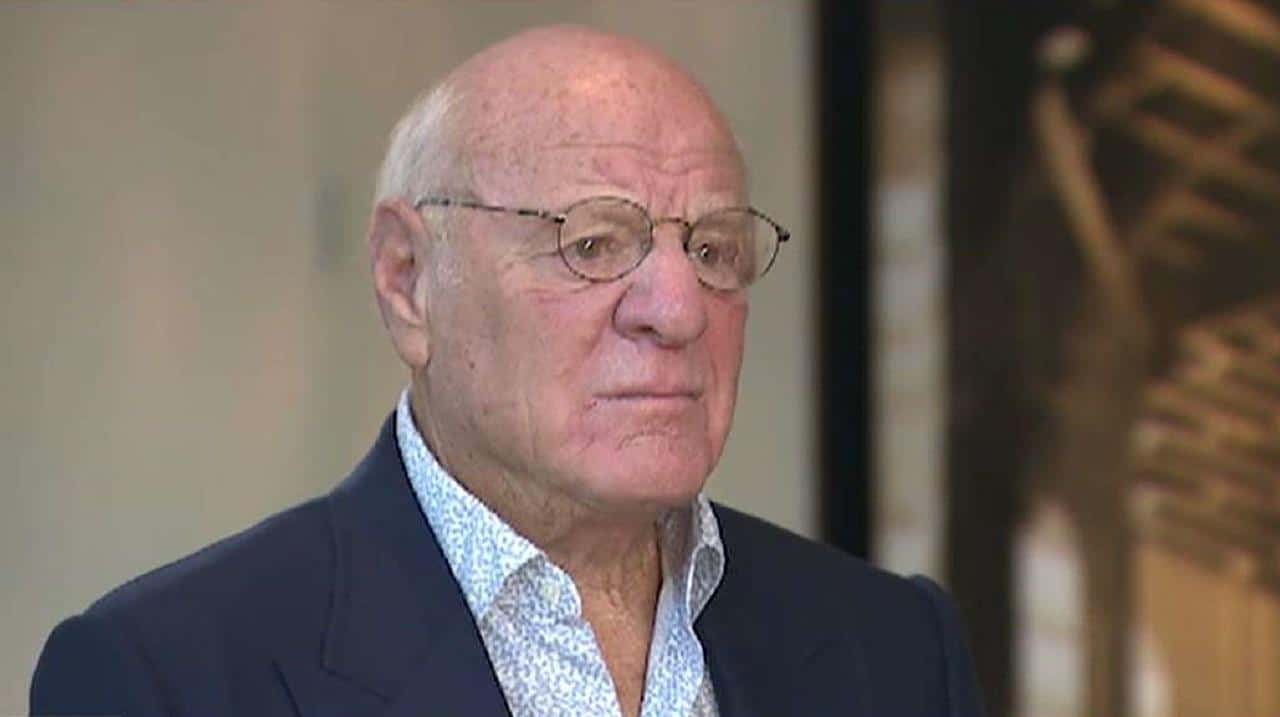

Billionaire media mogul Barry Diller on Tuesday urged investors to maintain sizable cash positions following the stock market’s robust rally from coronavirus-induced lows in late March.

“Personally, and professionally, every nickel you can, keep it … wherever it’s banked,” the chairman of both Expedia and digital media group IAC said on CNBC’s “Squawk Box.”

Diller noted that IAC in August announced a 12% stake in MGM Resorts International. But he said the roughly $1 billion investment made sense because the pandemic had ravaged the casino and gaming industry, providing the company an attractive opportunity in which “we would never lose our capital there.”

“Because of this moment, for bad reasons, we got the ability to invest in something like that,” Diller said. “But generally, I think for any speculation, and I think the market right now is a great speculation, I would stay home.”

Diller is far from the first to express skepticism about the stock market’s pandemic recovery, which saw the S&P 500 rise more than 60% from its intraday low of 2,191 on March 23 to its record high of 3,588 on Sept. 2. Stocks have given back some of those gains since, with the S&P 500 entering Tuesday’s session off about 8% from its intraday peak earlier in the month.

Some, such as billionaire investor Michael Novogratz, have suggested the pullback represents the end of a “speculative frenzy.” By contrast, other market watchers have described the declines as healthy given the months-long rally and contend it may create attractive buying opportunities, especially in high-flying tech names such as Apple.

Diller cited the upcoming presidential election between President Donald Trump and Democratic presidential nominee Joe Biden as a significant cause of uncertainty for investors.

“Each day from now until November is going to get more and more concerning, and more and more decisive, and more and more difficult,” said Diller, a longtime Democratic donor who has contributed more than $600,000 this year to the Biden Victory Fund, according to Federal Election Committee records.

“I actually think if I could wake up in mid-November, maybe it’s even late November given what might be contested, I would rub that magic genie,” added Diller, the former CEO of Fox and Paramount Pictures.

Biden currently leads Trump by 6.5 percentage points in an average of national polls compiled by RealClearPolitics.

Should the former vice president defeat Trump, Diller said he expects there to be an initial “downdraft” in the stock market as Wall Street braces for potentially higher taxes both on corporations and capital gains in a Biden administration.

“As far as business is concerned, I don’t think long term there’s going to be any particular difference” between Trump and Biden, said Diller. “I think there will be differences personally. I think people are going to pay higher taxes, particularly the wealthy. I think there are going to be things that are going to be done, really done, to deal with inequality.”

“I think other things will happen, I do not think they are — let’s call it — a big damper on business,” he argued, suggesting new regulations on large technology companies will be implemented under both a second Trump term or a Biden White House.

In the wide-ranging “Squawk Box” interview, Diller also criticized the negotiations surrounding Oracle and Walmart’s investment in social media app TikTok, which is owned by Beijing-based ByteDance and faced a potential U.S. ban from Trump. “The whole thing is a crock,” Diller said Tuesday.