After watching stocks march higher for nearly nine years, investors are suddenly confronting a new reality: The long, smooth ride is over. And it doesn’t feel good.

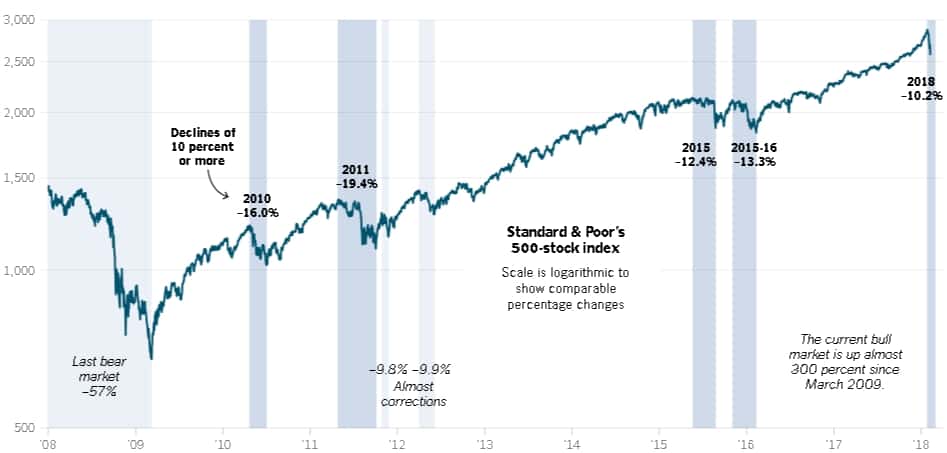

Major stock indexes suffered a steep drop in late trading on Thursday, the second straight day that stocks dived shortly before the markets closed. The 3.75 percent decline pushed the Standard & Poor’s 500-stock index down more than 10 percent from its peak in late January. That means the market is technically in correction territory — a term used to indicate that a downward trend is more severe than simply a few days of bearish trading.

“We’ve been trained that the market does nothing but go up,” said Bruce McCain, chief investment strategist at Key Private Bank, said of investors. “And then suddenly, they’re anxious, they’re sitting nervously on the sidelines, and then they can’t take it anymore.”

Trying to pinpoint the exact reasons for the last week’s tumble is a fool’s errand. But the most likely culprit appears to be fear that central banks will increase interest rates in an effort to fend off inflation and ensure that fast-growing economies don’t overheat. Those fears were stoked Thursday when the Bank of England warned that it might raise interest rates faster than investors had expected.

The past week has offered a vivid illustration of how, in a market dominated by fast-moving, computerized trading strategies, things can go from good to bad in the blink of an eye. Last Thursday, markets were on an epic winning streak. But a bad day last Friday was followed by more selling, which begot more and more selling.

In addition to the S.&P. 500’s drop on Thursday, the Dow Jones industrial average fell 4.15 percent. The Chicago Board Options Exchange Volatility Index — a measure of the choppiness of markets — surged by 21 percent.

The S.&P. 500 crested at 2,872.87 on Jan. 26. Since then, it has fallen almost 10.2 percent, or 292 points, to close at 2,581 Thursday.

The market correction doesn’t mean that the bull market in stocks — which have been roaring since March 2009 — is over. Markets also experienced a correction in early 2016 before shaking off their jitters and continuing to climb.

Indeed, such ups and downs are routine in most market environments. What makes the past week feel different is that an eerie calm had blanketed markets for the previous year.

Noah Weisberger, a managing director at AB Bernstein, said that over the past few decades, a 10 percent drop would normally happen every 18 months or so.

“It’s disquieting, it feels terrible, it’s eye-popping when you look at the screen, but it doesn’t yet tell you that something is broken,” he said. “It’s certainly a change in behavior relative to 2017, but then again, 2017 is an anomalous period with incredibly low volatility in the market, a very smooth glide-path higher.”

Now volatility is back — with a vengeance. Among the reasons for that is the rise of computer-driven trading, which can accelerate the pace of upward or downward price movements. When algorithms pick up “sell” signals, they can instantly shift trading strategies and move billions of dollars.

“That’s probably partly why you’re seeing these big swings in the market,” said Steve Massocca, managing director at Wedbush Inc., an investment firm. “I don’t think that’s being driven by human hands.”

The long bull market — stocks were up more than 300 percent at their peak in late January — has been underpinned, in part, by the extraordinary efforts of the world’s central bankers to re-energize growth in the aftermath of the American financial crisis and the deep global recession that followed.

Those efforts helped push interest rates to the lowest levels since World War II, making the safest investments unappetizing and prodding investors toward the stock market.

Now in the face of broad global growth, some think the central banks will raise interest rates faster than previously expected, eroding a crucial source of confidence that the stock market climb would continue.

Earlier Thursday, the Bank of England said as much, boosting its forecasts for economic growth and stating that it may have to raise interest rates “somewhat earlier and to a somewhat greater extent than we thought in November.”

That statement sent up interest rates — or yields — on British government bonds, known as gilts.

Yields on Treasuries followed suit, rising as high as 2.88 percent before retreating slightly. The sight of yields on United States government bonds approaching 3 percent seemed to give the markets pause.

Higher government bond yields can make it more expensive for individuals, companies and governments to borrow money. They serve, for example, as the foundation for the interest rates that banks charge on fixed-rate mortgages.

Investors are trying to figure out whether the global economy can keep growing at its current pace if rates rise — a concern that is contributing to the recent swings in stock prices.

But there’s reason to be optimistic about the economy’s resilience.

Government data released on Thursday showed that claims for unemployment insurance in the United States remain low, near levels not seen since the early 1970s. That suggests unemployment — which was 4.1 percent in January — will most likely remain low in the near future.

Corporate profits also appear solid.

But some of the biggest losers in Thursday’s rout were stocks that had done well this year. Canada Goose, for example, which had been up more than 20 percent this year, sank 16.6 percent. Tesla, which had climbed 10.8 percent this year, fell 8.6 percent.

Other hard-hit stocks belonged to companies that could be vulnerable to inflation because rising prices could pinch their profits.

On Thursday, the underwear and sock behemoth Hanesbrands saw its shares tumble nearly 11 percent, making it the worst performing stock in the S.&P. 500. Early in the day, the company offered a weaker than expected forecast for the year because of rising prices for commodities — although the company’s chief executive noted that Hanesbrands would try to pass some of those costs onto customers.

Even the most successful companies couldn’t dodge Thursday’s carnage. Shares of Apple fell 2.75 percent, knocking more than $22 billion off its market value.