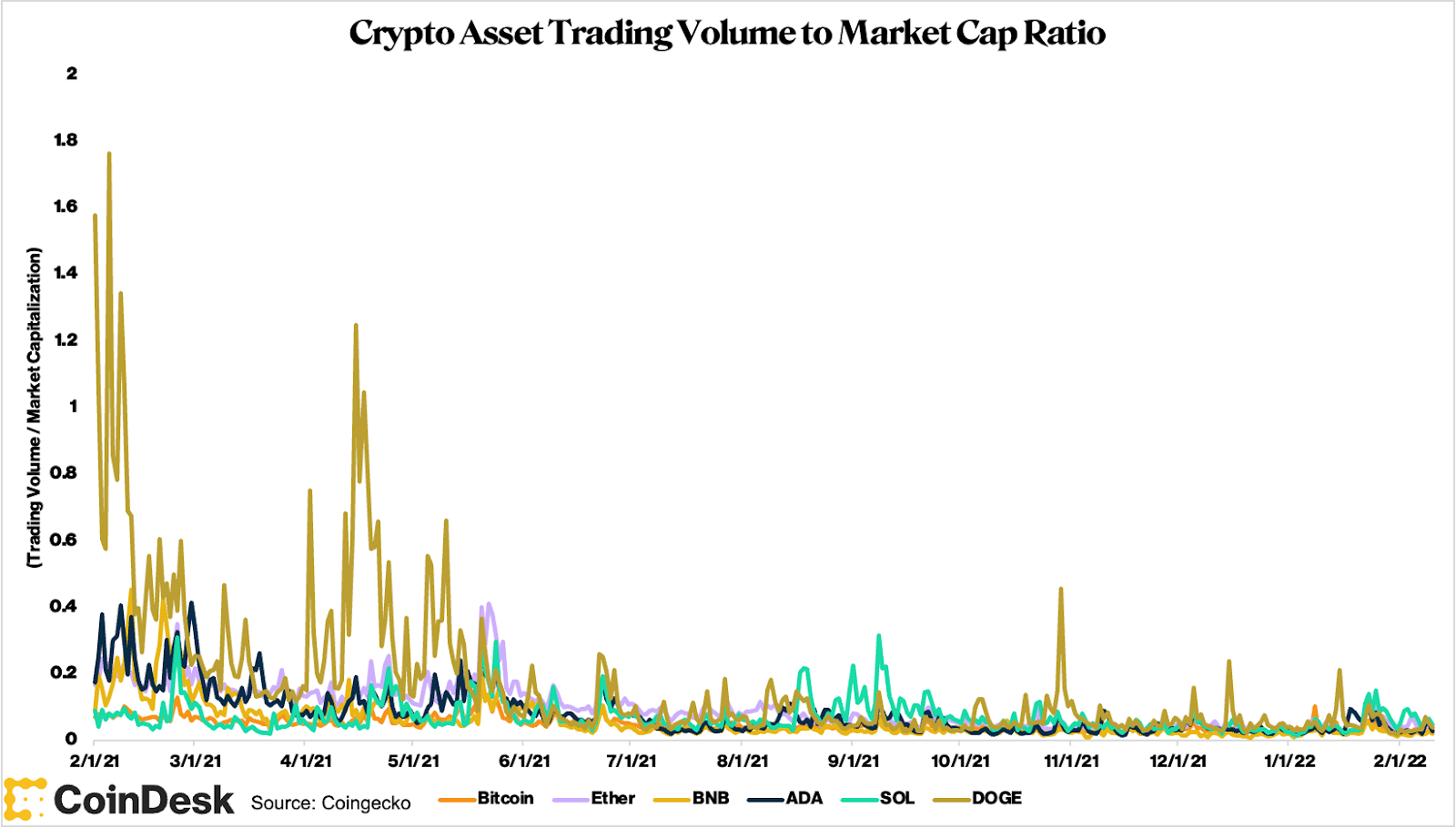

If it somehow feels as if cryptocurrency markets are relatively quiet, that’s because they are. That is, trading volumes as a percentage of market cap in many of the major cryptocurrencies are lower compared with previous months. The end result is that it may take smaller amounts of capital to move the markets wildly.

Just a year ago — Feb. 13, 2021 — bitcoin was trading at around $47,000. The day’s trading volume on centralized and decentralized exchanges taken together was nearly $62 billion and the market cap was just shy of $840 billion, according to data from CoinGecko. Thus, volume was about 8% of market cap.

On Wednesday, Feb. 9, 2022, bitcoin changed hands at $44,000, putting market cap at $837 billion. Yet volume was just $29 billion, or 3% of value.

That the market cap now is just about the same as a year ago drives home the point that the relative volume drop isn’t necessarily a function of price. The two examples given are representative rather than aberrations; for the month of February 2021, daily bitcoin volumes averaged around 8% of market cap, and over the past 30 days, it’s been 3%.

The drop-off for ether is even more dramatic. A year ago, the ratio of volume to value averaged 20% every day in February. Now it’s 4%.

Fine, those are the big two in crypto, but surely the same hasn’t happened elsewhere, you may say. However, you’d be wrong.

Layer 1s may be the talk of the town these days, but trading volumes on exchanges haven’t kept up with skyrocketing market caps. A year ago, February daily volumes versus value in BNB, cardano, solana and avalanche averaged 22%, 25%, 9% and 17%, respectively. Over the past 30 days, it’s been 2%, 5%, 6% and 4%.

As this data includes decentralized exchanges, the drop can’t be attributed all that much to the rise of decentralized finance (DeFi). Besides, decentralized exchange volumes in February 2021 were above $60 billion, according to data from Dune Analytics and published on DeFiPrime.com. That works out to a little more than $2 billion per day. In January, the total was $100 billion or north of $3 billion per day.

Yet ether, still the most important currency in decentralized finance, saw average daily volumes over the past month of $15.6 billion, but that’s down from $38 billion a year ago.

Speaking of DeFi, ratios in that sector also took a tumble, failing to keep pace with exploding values. Uniswap, which has the lion’s share of DeFi transactions and market cap for its token, was worth $6.8 billion a year ago and saw its token change hands to the tune of $1.5 billion daily. Now its market cap is $5.6 billion, and volumes on the uniswap token average just $223 million. Aave and cakeswap have suffered similar fates, albeit using smaller values.

Thinner markets, of course, mean that it doesn’t take as much to move prices as it once did. For an example, look no further than a week ago, Saturday, Feb. 5, when bitcoin finally broke above $40,000 and stayed there for the first time in over a week. Volumes the previous day were $16 billion, and on Saturday they were $25 billion. Again, these figures are low even by recent standards, but they serve as a reminder that it doesn’t take much to move a market.

That may be something to think about should we see large institutional entrants anytime soon.