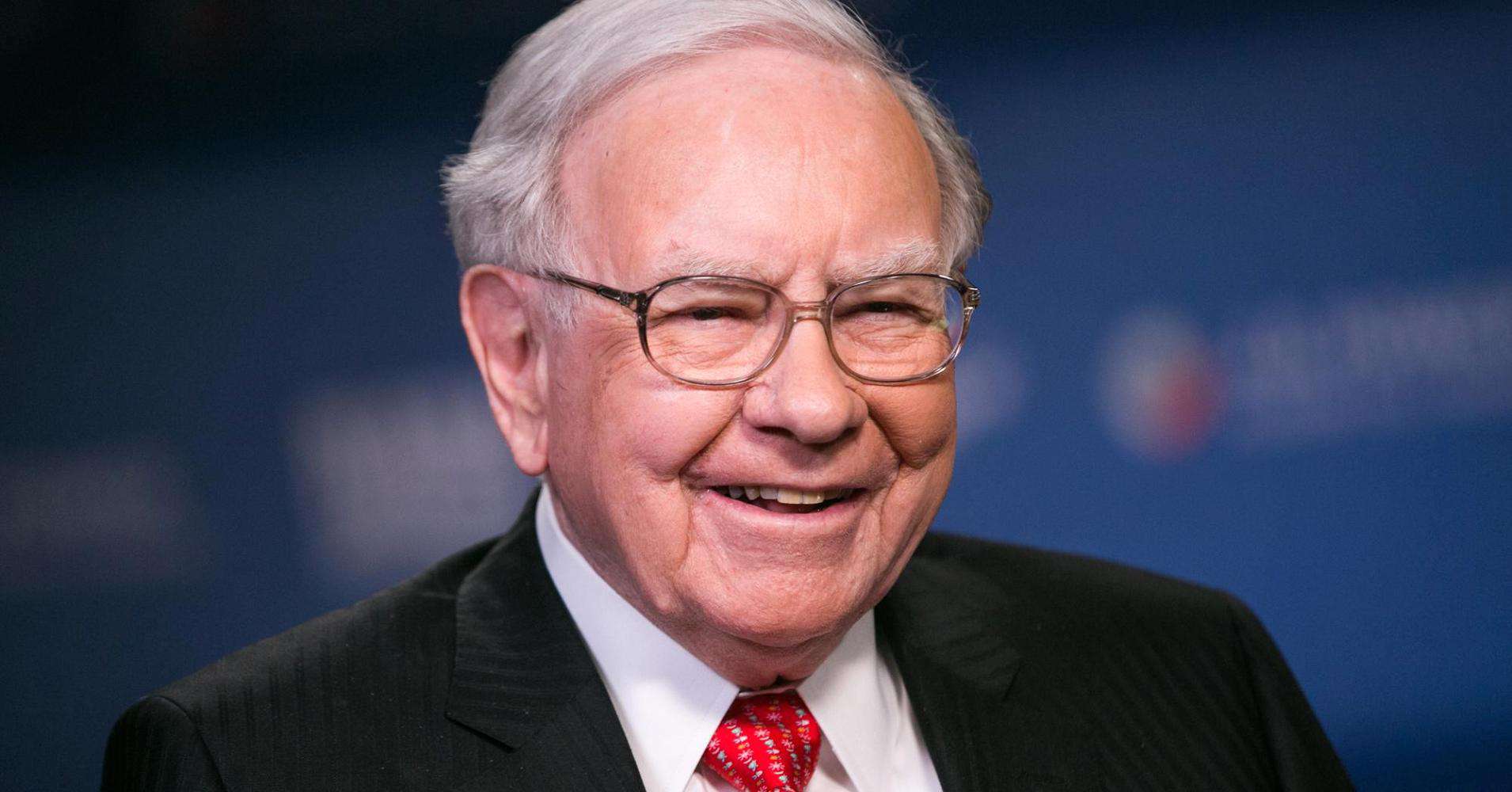

One decade ago, Warren Buffett took a $1 million wager that stashing money in an index fund would make you richer than if you entrusted it with hedge fund managers.

He won — big time — and in his annual letter on Saturday, the billionaire Chairman and CEO of Berkshire Hathaway (BRKA) Inc. outlined the final tally. He also took a jab at the hedge fund folks at the losing end.

His pick, the S&P 500 (OEX), gained 125.8% over ten years. The five hedge funds, picked by a firm called Protégé Partners, added an average of about 36%. The names of the funds were not disclosed.

The hedge funds “got off to a fast start, each beating the index fund in 2008. Then the roof fell in,” Buffett said. The S&P 500 won every year after.

He detailed a few key takeaways from the experiment.

Making money on the stock market “does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon,” he wrote. “What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals.”

“Stick with big, ‘easy’ decisions and eschew activity,” Buffett said.

One decade ago, Warren Buffett took a $1 million wager that stashing money in an index fund would make you richer than if you entrusted it with hedge fund managers.

He won — big time — and in his annual letter on Saturday, the billionaire Chairman and CEO of Berkshire Hathaway (BRKA) Inc. outlined the final tally. He also took a jab at the hedge fund folks at the losing end.

His pick, the S&P 500 (OEX), gained 125.8% over ten years. The five hedge funds, picked by a firm called Protégé Partners, added an average of about 36%. The names of the funds were not disclosed.

The hedge funds “got off to a fast start, each beating the index fund in 2008. Then the roof fell in,” Buffett said. The S&P 500 won every year after.

He detailed a few key takeaways from the experiment.

Making money on the stock market “does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon,” he wrote. “What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals.”

“Stick with big, ‘easy’ decisions and eschew activity,” Buffett said.

The expectation was that the bonds would grow to about $1 million at the end of the decade, and the winner would claim the prize pool for charity.

But, the bonds gave back “pathetic” returns, Buffett wrote.

“[O]ur bonds had become a dumb — a really dumb — investment compared to American equities” or stock, he said.

So, in 2012, Buffett and Protégé dumped their Treasury bonds and used the money to buy B-class shares of Buffett’s Berkshire Hathaway (BRKB) .

By the end of the bet, the Berkshire shares were worth $2,222,279 — about $1.2 million more than they’d hope to earn with the bonds.

“Berkshire, it should be emphasized, has not performed brilliantly” since they purchased the B-class shares in 2012, Buffett said. “But brilliance wasn’t needed: After all, Berkshire’s gain only had to beat that annual .88% bond bogey — hardly a Herculean achievement.”

In short, he summarized, the “purportedly ‘risk-free’ long-term bonds” ended up being a “far riskier investment” than common stocks.