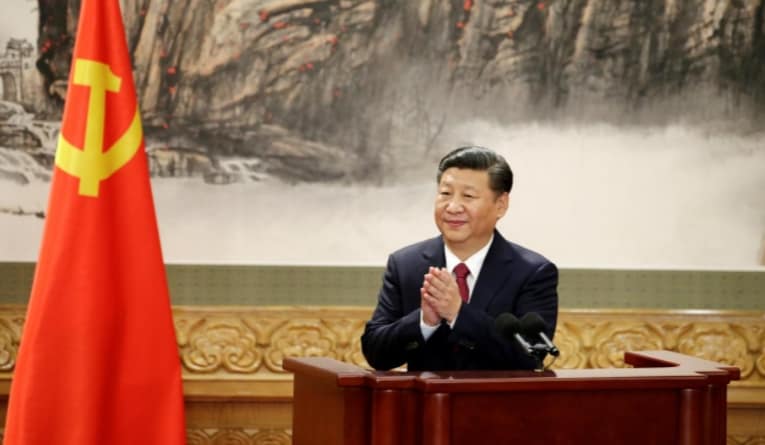

Chinese speculators pounced on stocks with “emperor” in their name on Monday, after the ruling Communist Party set the stage for President Xi Jinping to stay in office indefinitely.

The party proposed on Sunday to remove a constitutional clause limiting presidential service to just two terms in office, boosting prospects of Xi remaining in power after the end of an all but certain second term set to start next month.

Shenzhen Emperor Technology Co Ltd (300546.SZ) surged nearly 10 percent in morning trade, while Anhui Yingjia Distillery Co (603198.SS) – whose Chinese name includes the phrase “greeting the emperor’s carriage” – rose as much as 4 percent.

Harbin VITI Electronics Corp (603023.SS), which has words meaning “powerful emperor” in its name, shot up over 7 percent at one point.

The broader market .CSI300, meanwhile, rose less than 1 percent.

“This is pure ‘stir-frying’. It has got nothing to do with fundamentals,” said Yang Hongxun, Shanghai-based analyst at investment consultancy Shandong Shenguang, adding he expects those shares to be dumped “pretty soon”.

The “emperor” stock boost isn’t the first such play by Chinese speculators.

Last October, Hangzhou Huning Elevator Parts Co (300669.SZ), a little-known Chinese elevator maker whose name is similar to Chinese Communist Party theoretician Wang Huning, surged after Wang got promoted to China’s top political body.

In November, 2016, when news headlines pointed to the likely presidential election win for Donald Trump, shares jumped in Wisesoft Co Ltd – whose Chinese name sounds like “Trump’s big win”. Yunan Xiyi Industrial, whose Chinese sounds similar to “Aunt Hillary”, meanwhile slumped.

Bets on so-called “concept” stocks – a popular practice in China – underscore the enduring influence of short-term speculators, despite a campaign by regulators against “pump and dump” trading ahead of the inclusion this June of China’s A-shares in MSCI’s global indexes.

Shandong Shenguang’s Yang said the possible extension of Xi’s tenure could help ensure political stability and would be good for promoting deeper and wider economic reforms.

Yang’s view was echoed by brokerage Everbright Sun Hung Kai, which said a more powerful Xi could make policy implementation more efficient, for example at local government and state-owned enterprise (SOEs) levels.

But the market’s knee-jerk response to the proposed constitutional change already showed signs of being short-lived.

Vatti Corp (002035.SZ), whose name stands for “Chinese emperor” in Chinese, opened up 7.3 percent, but had retreated to be up just 1 percent by midday.

And meat products maker Huangshanghuang (002695.SZ), whose name mimics an address by subordinates to an emperor, also gave up sharp early gains.