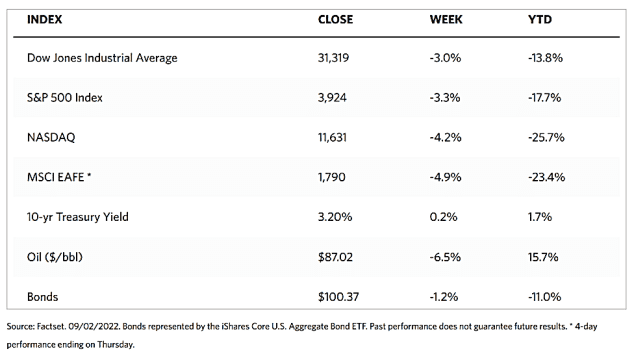

Stock Markets

Stocks ended in negative territory for the week as market participants continued to discount the ramifications of messages from the Federal Reserve officials pointing to more aggressive policy tightening ahead. Fed Chair Jerome Powell informed investors on Friday this week that they are committed to further raising rates in further attempts to rein in inflation until it “gets the job done.” The markets took this pronouncement seriously, causing a 3.29% drop in the broad S&P 500 for the week. The Dow Jones Industrial Average (DJIA) dropped 1.07% and its total stock market index dived 3.48%. The tech-heavy Nasdaq Stock Market Composite plunged 4.21% while the NYSE Composite also fell 3.22%. Markets will continue to remain volatile in the near term as a forecast remains for a further 75-basis point (0.75%) rate hike at the September FOMC meeting and a terminal fed funds rate of close to 4.0%. The previous forecast of a Fed rate cut for mid-2023 forecast appears to have been abandoned.

U.S. Economy

The week ended with the release of a resilient jobs report which, nevertheless, failed to lift the equities market. Uppermost in the concerns of many investors is the continued rate-hike policy by the Feds which threatens a possible deepening of what is currently seen as an economic recession. The expected pivot in Fed policy in the form of a rate cut by mid-2023 has morphed into a possible Fed pause. Investors are now focused on the forthcoming inflation readings upon which the Fed is anchoring any forward-looking actions.

There are some data points indicating that it is possible inflation has peaked and may soon be descending. Oil and commodity prices have begun to soften although they remain volatile. The ISM manufacturing prices announced last week fell to the lowest levels of the year. Wage gains remain steady and the housing market has begun to cool as mortgage rates ascended. Despite these developments, the overall inflation figures may move lower only after several months while other components remain sticky, namely rent, shelter, and broader services.

The labor market remains resilient. The August jobs report was generally in line with and even slightly higher than expectations. Nonfarm jobs rose by 315,000, higher than the 300,000 forecasted, signaling a relatively robust job market. It is noticeable that unemployment also rose, up to 3.7% from the previous 3.5%, although it remains close to record lows. Some labor supply appears to be returning to the workforce as labor force participation increased from 62.1% to 62.4%, staving off some worries of a supply shortage. Wage growth remains at 5.2%, moderating from peak levels that were set in March of this year.

Metals and Mining

The metal markets experienced a dismal summer which is coming to an end. Nevertheless, there remains no strong impetus to move metal prices forward and they continue to hover at current levels. Thankfully, the gold market ended the week off its lows at $1,700 where it has its strong support, but it still has not broken its losing streak of the past three weeks. Despite a bounce on Friday this past week, prices are only slightly above the critical initial support level. Gold’s sluggish performance is attributed to the growing competition posed by the dollar; further negative sentiment may push gold prices lower. Many investors are eyeing $1,685, which marks gold’s breakout parabolic move to $2,000 per ounce seen two years ago. Analysts speculate that if this level is broken significantly, this move could signal the end of the precious metal’s three-year bull market. Below $1,675, gold has little support on its way to $1,600.

Gold closed the week at $1,712.19 per troy ounce, down by 1.49% from its previous close at $1,738.14. Silver, which ended the week previous at $18.90, closed this week at $18.04 per troy ounce, down by 4.55%. Platinum ended the week at $839.05 per troy ounce, incurring a loss of 3.22% from the prior week’s close at $866.97. Palladium closed the previous week at $2,108.87 but ended this week at $2,024.00 per troy ounce for a loss of 4.02%. The 3-month forward LME prices for base metals also went southward for the week. Copper closed at $7,633.00 per metric tonne for the week, down by 6.46% from its close one week earlier at $8,160.50. Zinc ended this week at $3,135.50 per metric tonne, losing 12.06% from its previous weekly close of $3,565.50. Aluminum closed this week at $2,295.50 per metric tonne, down by 7.94% from the week-ago close at $2,493.50. Tin ended at $21,155.00 per metric tonne, for a loss of 14.53% from the previous week’s close at $24,750.00.

Energy and Oil

The slowdown in the Chinese economy has been the focus of this past week’s attention in the assessment of the future demand for energy and oil. The country’s PMI index for August registered only 49.4 which is roughly sideways from July, which investors see as a further delay in the much-anticipated economic activity rebound. Another concern is that the return of lockdowns in multimillion mega-cities, including Shenzhen or Chengdu, is likely to reduce oil demand as there is no way of predicting how long such measures will last.

The political instability in Iraq has further dampened any hopes of oil establishing a bullish trend, as much as the prospects of a nuclear deal for the country remain in limbo without political guarantees. Iran’s foreign minister stated that Tehran is seeking stronger guarantees from the U.S. for the nuclear deal to proceed, including an explicit no-snapback clause from Washington and a halt to IAEA probes into its nuclear program – conditions to which the U.S. will likely not agree. China-driven demand fears will continue to lead the market narrative, seeing ICE Brent down at $92 per barrel, until the OPEC+ meeting scheduled for September 5.

Natural Gas

For this report week covering Wednesday, August 24, to Wednesday, August 31, 2022, the Henry Hub spot price slid by $0.34 from $9.29 per million British thermal units (MMBtu) at the start of the week, to $8.95/MMBtu at the end of the week. Regarding Henry Hub futures prices, the September 2022 NYMEX contract expired Monday, August 29, at $9.353/MMBtu, higher by $0.023 from last Wednesday. The October 2022 NYMEX contract price declined to $9.125/MMBtu, lower by $0.17 for the week. The price of the 12-month strip averaging October 2022 through September 2023 futures contracts rose by $0.04 to $7.394/MMBtu.

Concerning international futures prices, international natural gas futures prices increased this report week to reach record-high levels, largely driven by natural gas supply constraints in Europe. The European market has experienced reduced pipeline flows from Russia and a maintenance event on the Nord Stream 1 pipeline. Weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia rose by $5.02 to a weekly average of $64.02/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas spot market in Europe, rose by $6.01 to a weekly average of $83.62/MMBtu, the highest weekly average price on record. Earlier in the report week, the price at TTF increased close to $100/MMBtu.

World Markets

European bourses plunged sharply on concerns that central banks could aggressively tighten monetary policy for a prolonged period. Fears that Russia might stop natural gas supplies to Europe likewise contributed to the negative investor sentiment. The pan-European STOXX Europe 600 Index fell on local currency terms, ending the week lower by 2.37%. Major indexes were mixed, with Germany’s DAX Index gaining 0.61% while France’s CAC 40 Index descended 1.70% and UK’s FTSE 100 Index losing 1.97%. Italy’s FTSE MIB Index was practically unchanged. Core eurozone government bond yields climbed due to record-high inflation and hawkish central bank comments. Peripheral eurozone bond yields and UK gilt yields followed the trend of core markets.

Eurozone money markets priced in an approximate 80% probability of an unusually large 0.75 percentage point rate increase by the European Central Bank (ECB) at its next meeting following a spate of hawkish comments by policymakers and the record inflation reflected by economic data. According to Executive Board member Isabel Schnabel, central banks should act “forcefully” to control high inflation, even at the risk of higher unemployment and lower growth, to reduce the risk of bad economic outcomes.

In the meantime, Japan’s stock exchanges registered losses for the week. The Nikkei 225 Index lost 3.46% while the broader TOPIX Index fell by 2.50%. The declines were attributed to the hawkish outlook by investors on U.S interest rate hikes and their likely impact on the Japanese economy. On this basis, the yield on the 10-year Japanese government bond rose to 0.24%, from 0.22% at the end of the previous week, driven by a sell-off in global bonds. The yen weakened on expectations of continued monetary policy divergence between the U.S. Fed policy and the monetary policy pursued by the Bank of Japan (BoJ), which remains committed to keeping its interest rates low. The yen fell to its lowest level since 1998, breaching the JPY 140 level against the dollar. This has improved Japan’s export competitiveness, although it has pushed up the cost of importing energy and food, thus increasing the burden on businesses and households.

China’s stock markets have once again fallen to the impact of coronavirus outbreaks in major cities that have triggered renewed lockdowns and weighed down the near-term economic outlook. The broad capitalization-weighted Shanghai Composite Index fell by 1.54% and the blue-chip CSI 300 Index, which tracks the largest listed companies in Shanghai and Shenzhen, retreated by 2.01%. In the southern tech hub of Shenzhen, a large segment of the city’s almost 18 million residents were restricted by virus-related control amid the country’s most serious spike since the spring. Chengdu, the capital of Sichuan province in southern China, was put under lockdown on Thursday with mass testing scheduled throughout the weekend. The southern port city of Guangzhou was also placed under severe restrictions. About 41 Chinese cities, which controls about 32% of the country’s gross domestic product, are currently under coronavirus control measures, the highest number since April.

The Week Ahead

Inventories and the PMI index are among the important economic data to be released this week.

Key Topics to Watch

- S&P U.S. services PMI (final)

- ISM services index

- Cleveland Fed President Loretta Mester speaks

- International trade balance

- Beige book

- Initial jobless claims

- Continuing jobless claims

- Quarterly services

- Consumer credit

- Wholesale inventories revision

Markets Index Wrap Up