Price Point

Bitcoin (BTC) was trading flat on Thursday, with little movement over the last 24 hours. The world’s largest cryptocurrency briefly dropped below $19,000 early Thursday but soon stabilized back just above at around $19,150.

Ether (ETH) was down slightly on the day, at around $1,290. It is still up slightly on the week, however

Top gainers on the day were Elrond’s EGLD and Huobi’s HT token, both up 3%.

In traditional markets, European stocks fell while yields on U.K. government bonds rose. U.S. stock futures slipped. Tesla’s shares dropped 5.4% in premarket trading after the electric-car maker reported third-quarter revenue that missed analysts’ expectations.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Chain | XCN | +12.17% | Currency |

| Radicle | RAD | +7.2% | Computing |

| Biconomy | BICO | +7.07% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Ribbon Finance | RBN | -5.38% | DeFi |

| MetisDAO | METIS | -2.88% | Smart Contract Platform |

| Rally | RLY | -2.75% | Culture & Entertainment |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

Chart of the Day

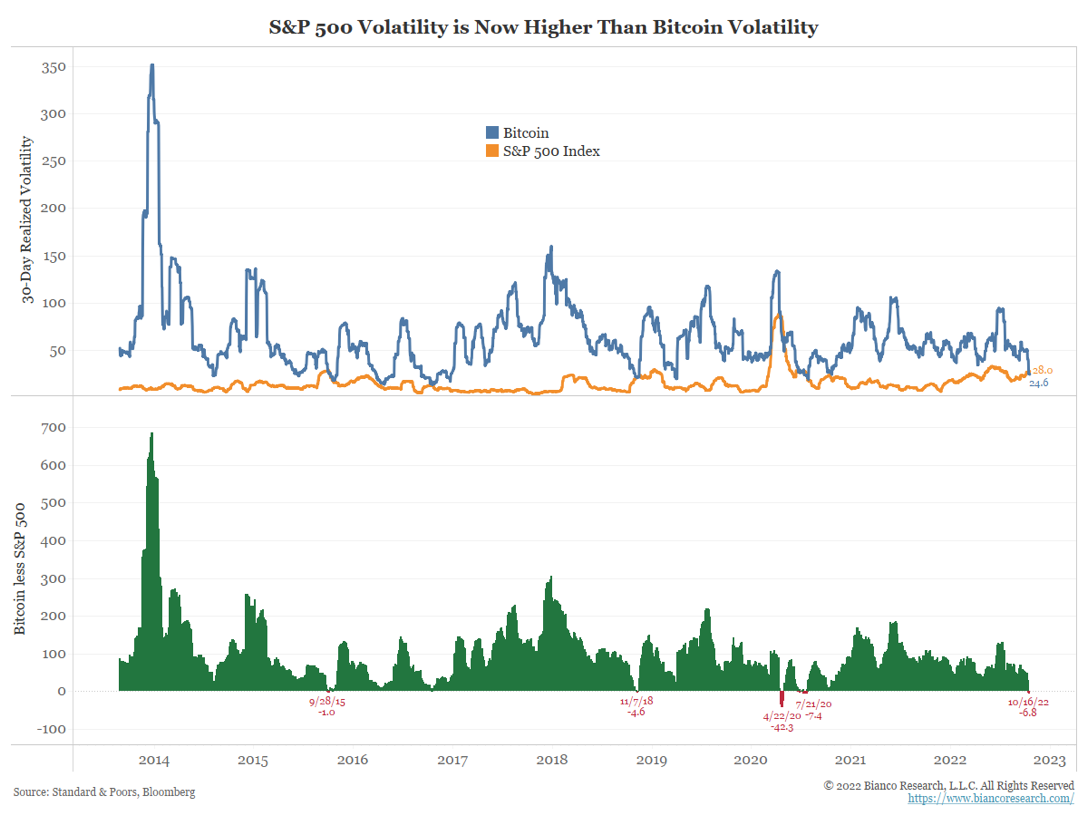

Crypto Volatility Meltdown in Full Swing

By Omkar Godbole

- Stocks have become more volatile than bitcoin for the first time since July 2021.

- “This has only happened on four other occasions in bitcoin’s history, each time near a significant local bottom,” Noelle Acheson, author of the Crypto is Macro Now newsletter, said in a note to subscribers.

- “Obviously, patterns don’t always repeat, but it is worth noting,” Acheson added.