Stock Markets

The holiday-truncated trading week produced gains in the major stock benchmarks. The Dow Jones Industrial Average (DJIA) climbed 2.39% while the Dow’s total stock market index likewise gained 1.98%. The S&P 500 Index added 2.02%, outperforming the technology-heavy Nasdaq Stock Market Composite which inched upward by 0.73%. The NYSE Composite advanced by 2.51%. Expectedly, the CBOE Volatility index plunged by 14.33%. For the first time in two months, the S&P 500 Index closed the week above 4,000. The market rally was fueled by favorable earnings reports in the retail and technology sectors. There are also indications that the Federal Reserve is increasingly amenable to loosening its policy and slowing the pace of rate hikes that it had pursued in recent months. Investors had overcome concerns early in the week regarding the potential repercussions of a fresh round of COVID-related lockdowns in China on global economies. Trading was light going into the Thanksgiving holiday.

U.S. Economy

The inflationary trend, and the Federal Reserve’s response to try to rein it in, appear likely to continue to drive markets in the months ahead. There is still no clear indication as to how far the Fed will need to hike interest rates further before inflation is brought under control. Investors, however, are of the view that the end of the tightening cycle is closer than the beginning, There is a stronger expectation that inflation will soon trend downward over the months to come, potentially shifting the market environment and lifting some of the pressure from investment portfolios.

The bond market was characterized by decreasing yields of longer-maturity Treasury debt by more than shorter maturities. This has led to a further inversion of the yield curve as bond prices and yields move in opposite directions. Municipal bonds traded higher from the start of the week through Wednesday, assisted by a continued pullback in interest rates and limited issuance in the course of the short trading week. Nevertheless, the bonds sector lagged U.S. Treasuries at the broad market level, prompted by the underperformance of long-maturity principals. While bonds typically move in the opposite direction to stocks to provide a buffer against stock-market losses, the quickly rising interest rates and demand concerns indicated that bonds entered into a bear market almost simultaneously as equities. Bonds, therefore, afforded little protection to the stock-market declines.

Metals and Mining

The price of gold continued to prove its resilience as it closed the week slightly above the $1,750 per ounce support level. The Federal Reserve provided a lifeline to the precious metal after the minutes from its November monetary policy meeting were perceived to have a more dovish undertone. A majority of the participants in the meeting saw that slowing the pace of rate increases will soon be justified by pending inflation rate slowdowns. The message advanced by the meeting is helping to strengthen expectations that the U.S. central bank will adjust interest rate hikes down to 50 (rather than 75) basis points starting next month. While the gold market is holding fast to the current support levels, precious metal investors still appear reticent to advance their bullish bids. The lack of confidence is not unjustified because past pivot rumors that have circulated through the summer have burned some investors who untimely entered the market. Despite the strong headwinds, however, gold continues to outperform the broad market and continues to remain an effective portfolio diversifier.

Gold ended this week at $1,754.93 per ounce, 0.24% higher than the previous week’s close at $1,750.68. Silver, which ended the week before at $20.94, closed this week at $21.75 per ounce, representing a gain of 3.87%. Platinum ended the week before at $981.87 and closed this week at $983.56 per ounce, inching upwards by 0.17%. Palladium came from $1,939.21 and ended at $1,847.69 per ounce, declining by 4.72%. The three-mo LME prices of base metals moved down across the board. Copper closed this week at $8,008.00 per metric tonne, down by 1.26% from the previous week’s closing price of $8,110.00. Zinc descended by 2.23% from the week-ago price of $2,987.00 to this week’s price of $2,920.50 per metric tonne. Aluminum, which closed the week before at $2,391.00, ended this week at $2,362.50 per metric tonne, for a weekly loss of 1.19%. Tin came from its previous week’s price of $22,584.00 to end this week at $22,231.00 per metric tonne, a decline of 1.56%.

Energy and Oil

Oil markets are once more impacted by bearish sentiments as China’s renewed COVID lockdown once more casts a pall over the global economic recovery. As the oil price cap comes into effect in only 10 days, clarification is desperately awaited by the oil markets on the actual details of the price limit. Although the European Union convened to align on a joint oil price cap, talks collapsed as members failed to agree on the best price point.

The reports of some media players suggested that the G7-proposed oil price cap level would fall within the range of USD 65 to 70 per barrel. This figure is substantially higher than what was first assumed. The proposal of the EU to cap gas prices, reportedly at €275 per MWh, was lambasted by member states. Discontent was fueled by the lack of clarity while Germany and the Netherlands claim that any cap would only shift supply elsewhere.

China’s COVID resurgence and pending reduction in economic activity have only pushed oil prices lower over the week. China’s daily recorded COVID-19 cases had risen to an all-time high in the past week, surging to more than 31,000 and prompting the government to lock down Henan and Guangdong once again. Beijing residents were subjected to the strictest restrictions since the pandemic began.

Natural Gas

For the week beginning Wednesday, November 16, and ending Wednesday, November 23, 2022, the Henry Hub spot price ascended by $2.29 from $3.45 per million British thermal units (MMBtu) at the beginning of the week to $5.74/MMBtu at the week’s end. Regarding Henry Hub futures prices, the price of the December 2022 NYMEX contract increased by $0.335, from $5.865/MMBtu to $6.200/MMBtu through the week. The price of the 12-month strip averaging December 2022 through November 2023 futures contracts rose by $0.203 to $5.349/MMBtu. International natural gas futures price movements were mixed this report week. Weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia declined $0.85 to a weekly average of $27.06/MMBtu, and natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.15 to a weekly average of $34.10/MMBtu.

World Markets

In Europe, equities rose for a sixth straight week on expectations that central banks are about to slow the pace of interest rate increases. The pan-European STOXX Europe 600 Index closed the week 1.66% higher than last week in local currency terms, France’s CAC 40 rose by 0.88%, Germany’s DAX Index added 0.62%, and Italy’s FTSE MIB remained unchanged. The UK’s FTSE 100 Index advanced by 1.16%. European government bond yields softened based on speculations that the region’s monetary policy may loosen soon. A survey conducted among purchasing managers suggested that the eurozone economy teetered on the brink of contractionary territory with inflationary pressures easing. The 10-year German government bond yields were kept subdued below 2%, while in the UK, the 10-year bond yields remained steady at about 3% as hopes for smaller rate hikes were broadly offset by concerns about record issuance.

In Japan, stock markets climbed during a holiday-shortened trading week. The Nikkei 225 Index rose by 1.37% and the broader TOPIX Index ascended by 2.59%. Positive sentiment was driven by expectations that the U.S. Federal Reserve would likely adopt a more dovish monetary policy stance soon. There are indications that inflationary pressures appear to be broadening in November, amid a rise in Tokyo core consumer prices, widely recognized as a leading indicator of nationwide trends. PMI data showed the first contractions in the Japanese manufacturing sector going back to January 2021. Furthermore, a recovery in the tourism industry continued to support the services sector which stagnated nevertheless. The yield on the 10-year Japanese government bond climbed to 0.25% from 0.24% where it ended the previous week. The yen strengthened to approximately JPY 138.7 against the U.S. dollar, compared to the earlier week’s exchange rate of JPY 140.3 to the greenback. The move was in response to the anticipation of a more dovish Fed policy and the Bank of Japan’s commitment to its ultra-liberal monetary policy. Inflationary pressures continue to build in November, though, with Tokyo’s core consumer prices rising by 3.6% year-over-year, higher than consensus estimates.

Chinese shares were moderately positive for the week, as investors balanced concerns over new coronavirus restrictions against declarations by authorities that they will provide greater support towards stimulating the economy. News of additional funding for property developers further boosted market sentiment. The Shanghai Composite Index added 0.76% while Hong Kong’s Hang Seng Index gained 0.59%. The COVID situation provided headwinds to the country’s economic recovery as cases soared to record highs. Several cities were placed under broad restrictions on movement, and mass testing was resumed to track the rise of daily coronavirus cases. No city-wide lockdowns have yet been announced, but the widespread restrictions have hampered economic activities across the country. Government authorities have stated that their responses will be more targeted and less disruptive. Eight districts in Zhengzhou, the site of Apple’s largest iPhone manufacturing facilities, will be locked down for five days beginning November 25 due to the virus reaching a “critical phase” in the region. This elevated tensions after workers at Foxconn’s plant, protesting unpaid wages and poor hygiene conditions, clashed with security personnel. To provide further support to the economy, the People’s Bank of China announced on Friday that it will cut the reserve requirement ratio (RRR) by 25 basis points. This is part of a pledge by the central bank to employ monetary tools “in a timely and appropriate manner” to maintain reasonably ample liquidity.

The Week Ahead

Important economic data scheduled for release in the coming week include real GDP, job openings and quits, PCE price index, and real consumer spending.

Key Topics to Watch

- MarketWatch interviews St. Louis Fed President James Bullard

- S&P Case-Shiller U.S. home price index (SAAR)

- FHFA U.S. home price index (SAAR)

- Consumer confidence index

- ADP employment report

- Real GDP (SAAR) revision

- Real gross domestic income (SAAR)

- Real domestic final sales (SAAR) revision

- Trade in goods deficit (advance)

- Chicago PMI

- Job openings

- Quits

- Pending home sales index

- Fed Chair Jerome Powell speaks at the Brookings Institution

- Beige Book

- Initial jobless claims

- Continuing jobless claims

- PCE price index

- Core PCE price index

- PCE price index (year-on-year)

- Core PCE price index (year-on-year)

- Real disposable income

- Real consumer spending

- S&P U.S. manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Motor vehicle sales (SAAR)

- Nonfarm payrolls (level change)

- Unemployment rate

- Average hourly earnings

- Labor-force participation rate, 25-to-54-year-olds

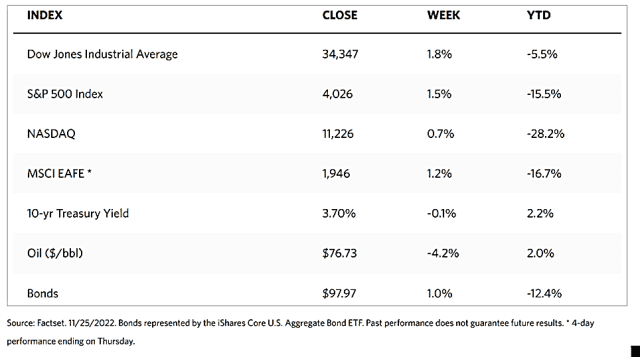

Markets Index Wrap Up