Stock Markets

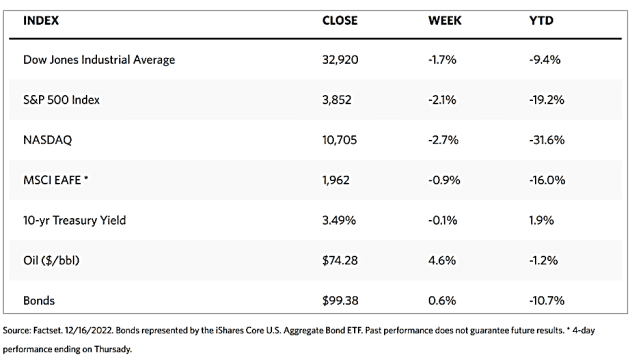

In the week just concluded, equities fell by more than 2.0% as market sentiment went southward in reaction to a more hawkish Federal Reserve meeting and weakening retail-sales data, despite higher than consensus November CPI inflation data. The Dow Jones Industrial Average (DJIA) dipped by 1.66% as the total stock market index fell by 2.04%. The broader S&P 500 declined by 2.08% while the Nasdaq Stock Market underperformed even more with a 2.72% loss and the NYSE Composite slid by 1.78%. CBOE Volatility came down slightly by 0.92%. As inflation comes under control, the economy is likely to soften in the months ahead and may require less restrictive policy. This tends to create a more volatile market in the near term on its way to greater stability in the long term.

In the meantime, fears intensified over the unexpectedly higher interest rates imposed by the Fed. This pushed the S&P 500 lower for the second straight week, returning it to the levels it had last visited about six weeks ago. Almost all sectors in this index registered sharp dives, except for energy shares which were sustained by a partial increase in oil prices. Additional volatility was sparked by the expiration of approximately $4 trillion in options contracts on Friday. Trading in exchange-traded funds (EFTs) approached record levels by midweek, suggesting that investors were moving in and out of stocks in general in reaction to broader economic signals.

U.S. Economy

The release of data regarding the Consumer Price Index on Tuesday indicated that headline inflation increased only by 0.1% from October to November, resulting in a year-on-year gain of 7,1%. This remains well above the long-term Fed inflation target of 2%, but optimistically, it is the lowest level since December 2021. Core inflation, which excludes food and energy, rose 0.2%, slightly below consensus expectations. This was largely driven by housing costs which are already showing signs of cooling. In 2023, policymakers expect the federal funds rate to expand to about 5%.

The 50-basis-point increase announced by the Fed this week fell in line with expectations, which should be a positive development given that the four previous meetings set 75-basis-point increases. Fed Chair Jerome Powell rattled the markets with his announcement that further aggressive rate hikes are expected. Thursday’s data on retail sales dropped 0.6% in November, contrary to the small increase expected by analysts in the post-Thanksgiving Black Friday and Cyber Monday sales season. Sales in the preceding two months were also revised downward.

Also, this past week, the Bank of England (BoE) and the European Central Bank (ECB) raised their policy rates by 0.50%. This brought the BoE’s and ECB’S target rates to 3.5% and 2.0% respectively. These central banks, like the Fed, announced that further rate hikes are likely into the New Year since inflation rates remain well above their targets. Some analysts see the global economy falling into a downturn in the first semester of 2023, with Europe likely to enter into a deeper recession that the U.S. due to its exposure to oil and energy markets and continuing decline in consumer confidence. Against this scenario, the global central banks may likely halt their rate-hiking policies, possibly by the end of the first quarter. The pause in rate increases may be taken to alleviate the pressure on the economy and determine whether inflation will continue to further slow down.

Metals and Mining

The precious metals prices continue to remain steady with gold holding on to the $1,800 per ounce support level. It appears that the gold market is taking the Fed’s hawkish stand in stride even as equities corrected sharply on the central bank’s signal that the key interest rate will peak at above 5% in 2023. There are a few reasons why gold is showing relative resiliency in light of the Fed’s announcement. One possibility is that investors are growing less worried about inflation and shifting their concern to a possible recession. A slowing U.S. economy is suggested by the disappointing holiday retail sales data announced this week. Another likelihood is that although the Fed continues in its restrictive policy, much of this information is already discounted in the current gold prices. The U.S. dollar also appears to have peaked as the Fed begins to slow the pace of its rate hikes.

Gold moved slightly downward by 0.24%, from the previous week’s price at $1,797.32 to this past week’s close at $1,793.08 per troy ounce. Silver followed suit with a correction by 1.07%, sliding from the week-ago price of $23.47 to this week’s close at $23.22 per troy ounce. Platinum began at $1,027.58 at the end of the week earlier and decreased to $994.53 per troy ounce this week for a loss of 3.22%. Palladium, which closed at $1,956.76 a week ago, ended at $1,720.75 per troy ounce this week, descending by 12.06%. The three-month LME prices for base metals also lost some ground. Copper closed at $8,266.50 per metric tonne this week, down by 3.24% from the previous week’s price of $8,266.50. Zinc, which formerly was priced at $3,240.50, lost 6.87% of its value week-on-week to end at $3,018.00 per metric tonne. Aluminum ended this week at $2,375.00 per metric tonne, down by 4.25% from the week-ago price of $2,480.50. Tin began at $24,290.00 and ended this week at $23,535.00 per metric tonne, down by 3.11%.

Energy and Oil

The price of oil has experienced its much-awaited rebound from its crash the week before, however, the downside pressures remain very much active. The BoE and the ECB hiked interest rates on Thursday, halting the upward momentum of oil prices that had been accumulating. Some hope to bulls may be provided by the ongoing halt in Keystone deliveries as it has created a tightness in the oil supply to the continent that has had a relatively secure year up to now. The traditional 2022 volatility may be expected in light of the uncertainty remaining to hover over China’s post-Covid reopening for the rest of the year. In the meantime, the International Energy Agency forecasts that next year will see further growth in oil demand by 1.7 million barrels per day. The push will be driven by China as it rebounds from this year’s contraction, adding 1 million barrels per day and reaching a new all-time high of 101.6 million barrels per day.

Natural Gas

For the report week spanning Wednesday, December 7, to Wednesday, December 14, 2022, the Henry Hub spot price rose by $2.07 from $4.53 per million British thermal units (MMBtu) to $6.60/MMBtu. The price of the January 2023 NYMEX contract rose by $0.707, from $5.723/MMBtu last Wednesday to $6.430/MMBtu week-on-week. The price of the 12-month strip averaging January 2023 through December 2023 futures contracts, rising $0.458 to $5.490/MMBtu. International natural gas futures price movements were mixed. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.48 to a weekly average of $33.46/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.50 to a weekly average of $42.46/MMBtu.

World Markets

European shares plunged after central banks in the region signaled that interest rates would need to be further raised and for longer periods than the markets previously expected. The pan-European STOXX Europe 600 Index closed the week 3.28% lower than the week previously in local currency terms. Major stock indexes mirrored this trend, with Germany’s DAX Index sliding 3.32%, France’s CAC 40 Index dropping 3.37%, and Italy’s FTSE MIB Index slipping 2.43% for the week. The UK’s FTSE 100 Index lost 1.93%. The ECB raised its key interest rate by 50 basis points to 2.0%. The increase was better than the 75-basis point hike in two previous rate increases. Nevertheless, ECB President Christine Lagarde said that the rate “will still rise significantly at a steady pace to reach levels that are sufficiently restrictive” for inflation to be reined in to reach the central bank’s target of 2%. Furthermore, the ECB indicated that it planned to shrink, by an average of EUR 15 billion per month, the portfolio accumulated as part of its Asset Purchase Programme. This will begin next March and run through the end of the second quarter of 2023.

Japan’s equities market lost ground over the week. The Nikkei 225 Index declined by 1.34% while the broader TOPIX Index declined by 0.58%. Investors lost their appetite for risk as a result of the Fed adopting a more hawkish stance on their monetary policy than was expected. There were concerns that continued monetary tightening by the major central banks could nudge the economy into a recession. The government finalized its tax revision package; meanwhile, the latest PMI data highlighted the divergence between a shrinking manufacturing sector and an expanding services sector. The yield on the 10-year Japanese government bond (JGB) generally remained unchanged week-on-week at 0.25%. It remains at the level at which the Bank of Japan (BoJ) implicitly caps JBG yields, in response to ongoing speculation that the BoJ may abandon its policy of yield curve control by early 2023. At its December 19-20 meeting, the central bank is widely expected to leave its monetary policy setting unchanged. The yen weakened to approximately JPY 137.1 against the greenback, from around JPY 136.5 per U.S. dollar the week before. The currency has come under pressure from the Fed’s restrictive policies.

As with their European and Japanese counterparts, Chinese stocks succumbed to selling pressure as weaker-than-expected economic data weighed on investor sentiment. The Shanghai Composite Index descended by 1.22% and the blue-chip CSI 300 Index dipped by 1.1%, reversing several weeks of gains. Investors got their cue from remarks made by Vice President Liu He indicating that Beijing is considering new measures to support the real estate industry, thus lifting property stocks. However, a trio of key economic indicators came in weaker than expected for November, weighed down by pandemic-related disruptions. Industrial production rose by 2.2% year-on-year in November, the softest growth since May. Retail sales declined by 5.0%, and fixed asset investment for the year through November likewise came short of forecasts. While China had recently begun to lift its more burdensome coronavirus restrictions, the country’s economic reopening is expected to be volatile. Recent reports described China’s economic activity as being depressed since the possibility of coronavirus cases spreading has discouraged the resumption of normal economic activity. Rising infections have left many businesses impacted by labor shortages.

The Week Ahead

Scheduled for release in the coming week are the leading economic indicators and the core PCE deflator.

Key Topics to Watch

- NAHB home builders’ index

- Building permits (SAAR)

- Housing starts (SAAR)

- Current account deficit

- Consumer confidence index

- Existing home sales (SAAR)

- Initial jobless claims

- Continuing jobless claims

- Real gross domestic product revision (SAAR)

- Real gross domestic income revision (SAAR)

- Real final sales to domestic purchasers (SAAR)

- Chicago Fed national activity index

- Index of leading economic indicators

- PCE price index

- Core PCE price index

- PCE price index (year-on-year)

- Core PCE price index (year-on-year)

- Real disposable income (SAAR)

- Real consumer spending (SAAR)

- Durable goods orders

- Core capital equipment orders

- UMich consumer sentiment index (late)

- UMich 5-year inflation expectations (late)

- New home sales (SAAR)

Markets Index Wrap Up