Stock Markets

The broad-based S&P 500 Index took a deep dive amounting to 4.55% of its value over the previous week as investors unexpectedly received more tough talk from Federal Reserve Chair Jerome Powell regarding their forthcoming monetary policy stance. Powell and his fellow policymakers had more work to do to cool down inflation and the hot labor market. The S&P 500 Index fell to its lowest intraday level since January 5. The sell-down was precipitated by the index descending below both its 100-day and 200-day moving averages, a selling signal followed by technical traders. Large-caps were underperformed by small-caps while value stocks dropped further than growth stocks. As a result, the Russell 1000 Value Index was pushed into negative territory reckoned on a year-to-date basis. The markets began their descent on Tuesday morning after Fed Chair Powell testified before Congress that if inflation maintains its current trajectory, the policymakers were prepared to hasten the pace of tightening and raise rates higher than anticipated.

The Dow Jones Industrial Average (DJIA) plunged by a hefty 4.44% over the past week as the total stock market index lost 5.13% of its value from the week before. The technology tracking Nasdaq Stock Market Composite was slightly more resilient although it did plummet by 3.75%. The NYSE Composite also lost by 5.26%. The CBOE Volatility risk perception indicator shot up by 34.14% for the week. Within the S&P 500 financial stocks led the decline and accounted for the notable weakness in value stocks. Over the week, concerns mounted regarding the continued viability of Silicon Valley Bank, or SVB Financial, as customers withdrew their deposits after SVB, a technology-oriented regional bank, was forced to sell and realize losses in securities held on its balance sheet to meet capital requirements. The Wall Street Journal called this the second-biggest bank failure in U.S. history. On Friday morning, trading in SVB stock was halted, after which the Federal Deposit Insurance Corporation (FDIC) placed the bank under receivership to protect the depositors. Symptomatic of a contagion, stocks in other regional banks fell in response to SVB’s fall, albeit moderately, which suggested that SVB’s predicament was exceptional rather than systemic.

U.S. Economy

Fed Chair Powell noted in his Congressional testimony that the process of pulling inflation back to the Fed’s long-term target of 2% will likely be rocky. After the broad reversal of the disinflationary trend in January, the stronger recent economic data suggested that the ultimate level of interest rates may be higher than expected, thus the caution against prematurely loosening policy. He also referred to the challenges posed by the tight labor market. Over the past week, mixed signals were received regarding what success was attained by the Fed’s past rate hikes in cooling wage pressures, if any. Surprising on the upside was payroll processor ADP’s tally of private sector employment that was released on Wednesday. The report showed an increase of 242,000 jobs in February which is approximately twice January’s increase. However, separate data on job openings missed the consensus expectations while fewer people than expected quit voluntarily. The latter is considered a better indicator of how Americans perceive the job market. The weekly unemployment claims figure that was reported the next day also hit their highest level since late December, although several one-off idiosyncratic factors may have been at work, as some have noted.

The closely watched official payrolls report showed nonfarm jobs in February to have increased by 311,000, well above the consensus estimate of 200,000. However, the unemployment rate rose unexpectedly from a five-decade low of 3.4% in January to 3.6% the month after. Average hourly earnings rose slightly less than expected, by 0.2%, due mainly to many new jobs opening in relatively low-paying sectors. Nearly 6 out of 10 jobs created in the private sector in February were in the leisure and hospitality and retail trade sectors.

As markets opened on Friday, the two-year yield fell from 4.9% to just above 4.6%. This appears consistent with speculation that SVB’s troubles might cause the Fed to temper its interest rate hikes to avoid further stresses in the financial system, spurring a plunge in short-term interest rates. The flight to safety on Friday left the yield on the benchmark 10-year U.S. Treasury note down by approximately 27 basis points for the week, as bond prices and yields move in opposite directions.

Metals and Mining

The gold market is once more showing its nature as a safe-haven asset as the week ends with the biggest bank failure since the early days of the 2008 Global Financial Crisis. On Friday, California state regulators seized SVB and appointed the FDIC as its receiver, SVB was known to provide venture capital to tech startups and support for cryptocurrencies. After it announced plans to sell shares to raise capital for regulatory compliance, the bank saw a run on its deposits as clientele hurriedly flocked to withdraw whatever deposits they had in the bank. SVB needed to raise money to cover a $1.8 billion deficit after loss-making assets, mostly U.S. government bonds. The bank’s bond and mortgage-backed securities have taken a major hit as the Fed has aggressively raised interest rates to cool down inflation. The more dire the economic developments, which may soon move towards a recession, the better it is for the gold market as a safe-haven asset. Some analysts are predicting that gold prices may reach $2,000 an ounce by the end of this year.

In the week just ended, gold gained 0.63% from its previous week’s close at $1,856.48 to this week’s close at $1,868.26 per troy ounce. Silver lost some ground from last week’s close at $21.26 to this week’s close at $20.54 per troy ounce, a loss of 3.39%. Platinum also corrected from last week’s ending price of $982.66 to this week’s ending price of $964.88 per troy ounce, losing by 1.81%. Palladium also went down from last week’s close at $1,458.45 to this week’s close at $1,383.98 per troy ounce for a loss of 5.11%. the three-month LME prices for base metals were generally down for the week. Copper went from the previous week’s closing price of $8,958.50 to this week’s close at $8,853.00 per metric tonne, a loss of 1.18%. Zinc came down from the week-ago ending price of $3,048.00 to this week’s close at $2,974.00 per metric tonne for a drop of 2.43%. Aluminum, which ended at $2,399.50 a week ago, closed this past week at $2,328.00 per metric tonne for a loss of 2.98%. Tin closed at $24,570.00 last week and at $23,351.00 per metric tonne this week, for a descent of 4.96%.

Energy and Oil

The big story over this past week was the prospect of higher and potentially even accelerated U.S. interest rate hikes, rattling most financial and commodities markets, oil and energy included. Concerns have been rekindled that the oil demand impact might be worse than initially expected, leading to the most precipitous weekly loss since January. Without any compelling bullish story to offset the shocks rippling through the financial markets in the next two weeks, bearish sentiment may likely continue to build in the oil markets. In the U.S., President Joe Biden is expected to put forth a budget that would scrap oil and gas subsidies worth tens of billions of dollars, including drilling incentives, although this proposal has little chance of successfully being passed by a divided Congress. Furthermore, a group of bipartisan U.S. senators has reintroduced the NOPEC bill on the House’s Judiciary Committee. The bill was first introduced 22 years ago; it may lead to the potential filing of lawsuits by U.S. authorities against OPEC+ national oil companies for price collusion.

Natural Gas

In local news, despite the partial restart of Freeport LNG’s repaired units, industrial regulators from the FERC and PHMSA have sent another list of requests to the operating company, asking it to address operator fatigue and the training status of new hires. In international news, the Middle Eastern island kingdom of Bahrain is seeking to cut domestic gas production amidst its decarbonization drive that relies heavily on new solar plants and simultaneously wants to build an LNG terminal to export liquefied natural gas to international markets.

For the report week from March 1 to March 8, 2023, the Henry Hub spot price fell by $0.09 from $2.59 per million British thermal units (MMBtu) at the beginning of the week to $2.50/MMBtu at the end of the week. The price of the 12-month strip averaging April 2023 through March 2024 futures contracts declined by $0.142 to $3.385/MMBtu. International natural gas futures prices this report week decreased to their lowest level since July 2021. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.55 to a weekly average of $14.21/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid LNG market in Europe, decreased by $1.44 to a weekly average of $13.66/MMBtu. In the corresponding week last year (for the week ending March 9, 2022), the prices in East Asia and at TTF were, respectively, $43,12/MMBtu and $61.08/MMBtu.

World Markets

European shares fell in tandem with global markets due to concerns about shocks in the banking system and the possible effects of a prolonged period of high-interest rates. The pan-European STOXX Europe 600 Index descended by 2.26%. Major stock indexes in the region likewise lost ground. Germany’s DAX Index fell by 0.97%, France’s CAC 40 Index dropped by 1.73%, and Italy’s FTSE MIB Index declined by 1.95%. The UK’s FTSE 100 Index plunged by 2.50%. Meanwhile, the Eurozone economic growth in the fourth quarter was revised downward from its initial estimate of 0.1% to 0.0%, Consumer demand weakened in January. Retail sales grew much less than expected, by 0.3% sequentially, and dropped 2.3% from their levels one year ago. Over the week, eurozone policymakers pressed for the European Central Bank (ECB) to continue raising interest rates after its march meeting to control inflation.

Japan’s equities markets recorded modest gains for the week. The Nikkei 225 Index rose by 0.78% while the broader TOPIX Index rose by 0.60%. The increase was a sign of resiliency despite a sell-off in Japanese bank stocks on Friday, following a slump in their U.S. counterparts, as well as the Bank of Japan’s (BoJ) decision to leave its accommodative monetary policy unchanged in March. The yield on the 10-year Japanese government bond (JGB) was sent sharply lower by the central bank’s continued commitment to its ultra-loose stance on monetary policy. The yield on the 10-year JGB finished the week at 0.42%, from 0.50% at the end of the previous week. The yen weakened to about JPY 136.7 against the U.S. dollar, from around JPY 135.8 per greenback the prior week. The Japanese currency came under pressure due to the dovish policies of the BoJ, as well as stronger-than-expected U.S. economic data and hawkish messaging from the Fed that renewed fears of continued steep rate hikes.

Chinese equities fell back due to signs of weakening demand and a lower-than-expected 2023 growth target unveiled by Beijing. The Shanghai Stock Exchange slid by 2.95%, the worst weekly loss in more than two months, while the blue-chip CSI 300 fell by 3.96% in local currency terms. In Hong Kong, the benchmark Hang Seng Index plunged roughly by 6%, its largest weekly loss in more than four months. China’s consumer price index rose by 1% in February year-on-year, short of forecasts, and down from a 2.1% rise in the previous month. Core inflation rose 0.6% in February from 1% in January, as producer prices fell by more than expected due to lower commodity costs. China’s inflation remains muted compared to the U.S. and Europe, raising expectations that the central bank will maintain its supportive policy stance.

The Week Ahead

In the week ahead, the consumer price index, retail sales, and producer price index are among the important economic data scheduled for release.

Key Topics to Watch

- NFIB Optimism index

- Consumer price index

- Core CPI

- CPI (year over year)

- Core CPI (year over year)

- Retail sales

- Retail sales ex-autos

- Producer price index

- Core PPI

- PPI (year over year)

- Core PPI (year over year)

- Empire State manufacturing

- Business inventories

- Homebuilders survey

- Initial jobless claims

- Import price index

- Housing starts

- Building permits

- Philadelphia Fed manufacturing

- Industrial production

- Capacity utilization

- U.S. leading economic index

- Consumer sentiment

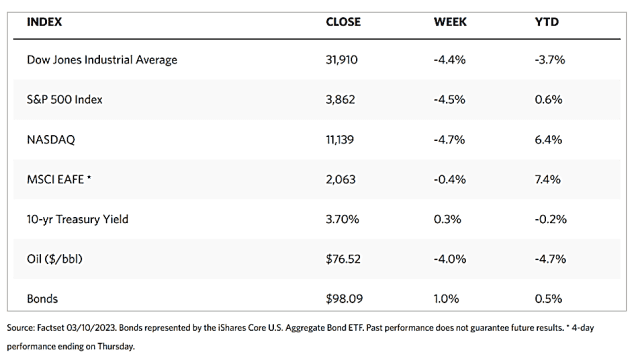

Markets Index Wrap Up