Eating healthy can be expensive, which is true with food prices going up. How can a family make it on a limited budget? Check out these shopping tips. • Plan meals in advance. By spending 30 minutes a week planning out meals and snacks, a family could save up to $10 a week. Doesn’t sound […]

Category: Finance

Ervolino: Yes, you can trim your pet food budget without sacrificing good health

Every three or four weeks, I take my coonhound, Charly, to her groomer, Antonio. He cleans her ears, brushes her teeth, shampoos her hair, clips her nails and, for the grand finale, ties a chic bandanna around her neck. All Charly needs is some oversized sunglasses and she’d look just like Audrey Hepburn in “Breakfast […]

Pet Tax Deductibility

In general, deducting pet expenses on your tax return can get you into hot water with the Internal Revenue Service (IRS). Usually pet expenses will not hold up should the IRS audit you. However, specific cases exist that allow you to take legitimate tax deductions for spending on your pet. Regardless of how you justify […]

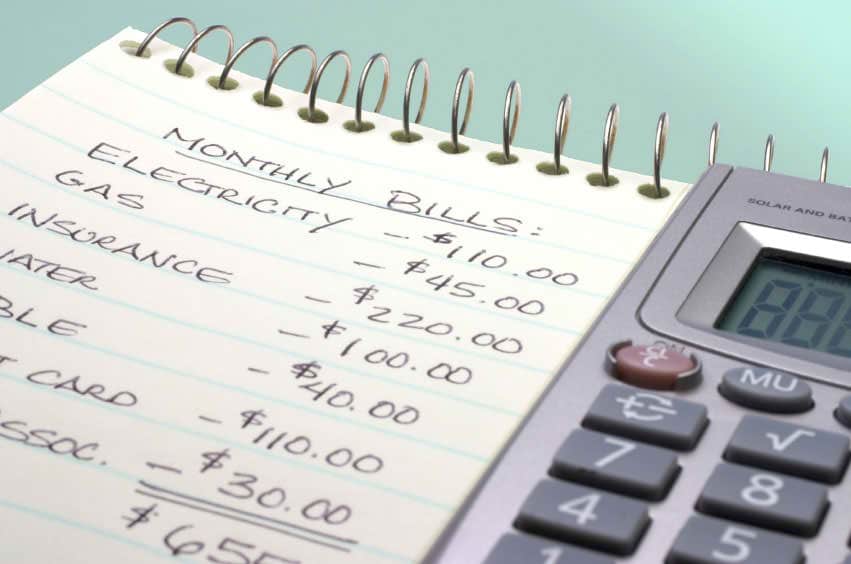

Top Tip: Have a personal finance day every month

Just as we all enjoy a day to ourselves; be it for shopping or a day at the spa – everyone should have a Personal Finance Day. What is a personal finance day? A Personal Finance day is a day set aside each month to sort out your personal finance needs. This will help you […]

6 Personal Finance Habits Everyone Should Get Into

Though Americans are slowly but surely ramping up their savings game, most are still falling short in that arena. An estimated 57% of U.S. adults have less than $1,000 available in savings, while 39% have absolutely no savings at all. Clearly, this means most of us need to do better. With that in mind, here […]

Do Your Taxes. Then, Read These Books

As you gather your receipts and W-2s this tax season, you may be inspired to tackle your overall financial well-being. Here are three books that can help. YOU ARE A BADASS AT MAKING MONEY Master the Mindset of Wealth By Jen Sincero 269 pp. Viking. (2017) According to this book, if you want to make […]

Don’t Let Taxes Kill Your New Business

It is an exciting time when you start your new business. You have so many things to think of that you may forget one of the most important aspects — taxes. Before you dive into the business world, take a few minutes to consider the tax aspects of your new business. Your tax obligations are strongly affected […]

How Gig Workers View Their Jobs, Personal Finances Will Surprise You

Do you think gig workers — mainly freelancers, contractors, part-timers and temporary workers — are too busy scrambling for their next gig to bother thinking about retirement planning and other aspects of their personal finances? If so, think again. Seventy-eight percent of gig workers believe they are more involved in their personal finances as a […]

How personal finance know-how helps your business

Operating a small business is a dream for many people. You can be your own boss. You may have a more flexible schedule, as well as the potential to earn more income. And you just might change the world. But when you are CEO, CFO, CMO and COO of your company, how do you stay […]

25 money-saving tips to help you make the most of your holiday

1) Timing Is Everything: Consider the travel before booking the flights for that bucket list trip. Prices can vary hugely based on time of year, whether you are travelling midweek or on bank holidays. Using an overview website like skyscanner.net can save you serious money when choosing the correct flight. 2) Don’t Be Schooled: Identify school holidays […]

Four goals for financial fitness

The chances are that those New Year’s resolutions to save more, eat better and exercise have fizzled out. That’s the problem with making impulse decisions when you are full of New Year bonhomie, rather than making concrete plans you’ve thought through and intend to stick to. If you are serious about the financial and lifestyle […]

8 steps to organise your personal finances in the new financial year

The beginning of a new financial year is an ideal time to review your financial plan, set your financial goals for the year and plan beforehand rather than leaving everything for the last day. Let us look at 8 important actions financial advisors recommend you should take now from a personal finance perspective. 1. Review […]