For the Average Joe, even if you feel you’re doing well with your finances, you could probably stand to make a few changes to your financial habits. If you’d like to spend less and save more, here are a few things to think about… Be smart with credit cards: A credit card can be a […]

Category: Finance

Better Business Bureau’s tips to save money all year-round

You can substantially lower your monthly expenses and save money without making sacrifices, according to Better Business Bureau Serving Connecticut. Start by taking a hard look at how much you spend each month or year on fixed costs such as your mortgage, entertainment and communications. “In many cases, all you have to do is make […]

Saving Money On Things You Use Everyday.

Did you make a resolution to save money for you and your entire family? If so, trying to find different ways to stay on a budget to cut back costs can be a challenge. Getting everyone on board is the only way to do it. From slashing your grocery bill to cutting back on spending […]

Double Decker Bus Company Shares Tips on Visiting the Big Apple on a Shoestring Budget

TopView NYC, a sightseeing company in New York, shares insider tips for visiting the city on a budget New York is one of the most popular travel destinations in the world, but it’s also one of the most expensive. Even a weekend trip could cost well over $1,000 if a traveler isn’t careful with spending […]

Self-made millionaire: These 5 habits may be keeping you broke

Entrepreneur, best-selling author and self-made millionaire Grant Cardone wasn’t born into riches, he writes in a recent blog post. “I have worked hard my whole life to create wealth and success for myself, my family and my community. I was not born with a silver spoon in my mouth.” And while “I do not ever […]

4 Personal Finance Rules You Should Know by Heart

These are four of the most important things you can do to live a financially healthy life. A general personal finance rule is to avoid credit card debt at all costs. It’s typically better to finance something with a personal loan, home equity loan, or even a 401(k) loan than it is to pay double-digit […]

How Interest Rates Affect Every Aspect of Your Personal Financial Life

If you’ve ever made a student loan payment or carried a credit card balance into a new month, you already know how interest rates work. In those cases, it’s the percentage tacked onto your principal debt, or the price you pay later for borrowing money now. These rates are intertwined with every aspect of our […]

Investments: Is big also beautiful for fund investors?

TOP FUND managers look after vast sums on behalf of ordinary investors, which means that millions are entrusting them with their future prosperity. The five most popular actively managed funds now hold an incredible £80 billion among them, but size is no guarantee of success. You should check the performance of all your funds regularly, […]

3 ways debt settlement may not be the fix you expect

Paying less than you owe to creditors sounds like a good deal. But debt settlement isn’t what it seems. If you’re considering working with a debt settlement company — which negotiates with your creditors to accept less than what you owe — look beyond the marketing pitches. These programs have inconsistent results and can be […]

Kiplinger’s Personal Finance: How to check the financial health of a continuing care retirement community

Community care retirement communities promise to see retirees through independent living to skilled nursing care — usually for a hefty upfront fee. Before turning over a chunk of your nest egg to a community, check out its financial stability and services first. Begin by digging deeper into the quality of its health care. Use the […]

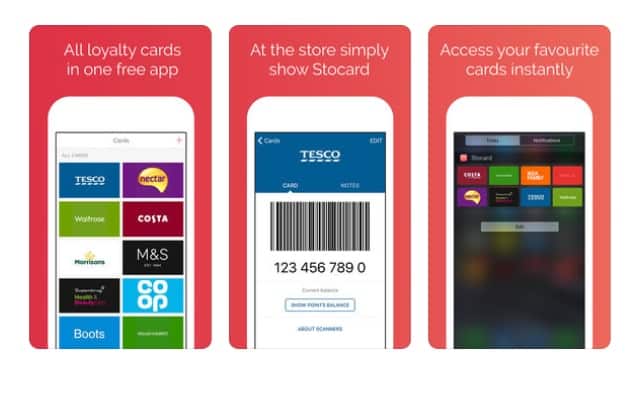

Ditch the plastic loyalty cards and start saving money with these personal finance apps

People often say that one of the reasons why they don’t save money is because they find it difficult to keep track of what they’re spending. Fortunately, there are lots of money apps out there that can help with this. We round up the best, which are all available on iOS and Android. Stocard This […]

Running low on money? Our tips on how to give yourself a cash boost

January can be a tough month for our finances. Not only is a long stretch between being paid before Christmas to your next pay date in January, but there’s also that post-Christmas squeeze many of us feel at this time of year. Top this off with it being deadline day on January 31 to complete […]